📖 The Big Picture

Markets work like auctions - price moves between two states:

1. Balance - Price bounces around a fair value (happens 70% of the time)

2. Imbalance - One side takes control and pushes price to find new fair value

❌ The Problem

Most traders lose because they trade breakouts without checking if the market is balanced or not.

✅ The Solution

Only trade when three things align: Market State + Location + Aggression

📊 Setup 1: TREND MODEL

Ride the Wave

Follow strong moves in the direction of the trend

Best Timing

- New York session (NASDAQ, ES)

- Avoid London open (too many fake breakouts)

STEP 1: Confirm the Market is Trending

Look for clear momentum away from the previous range

If price is just bouncing up and down → Skip this setup

STEP 2: Find Your Entry Level

- Take the strong move that broke structure

- Apply Volume Profile to that move

- Find LVNs (Low Volume Nodes) - gaps where price moved fast

- Set alerts at these LVNs (don't enter blindly)

STEP 3: Wait for Confirmation

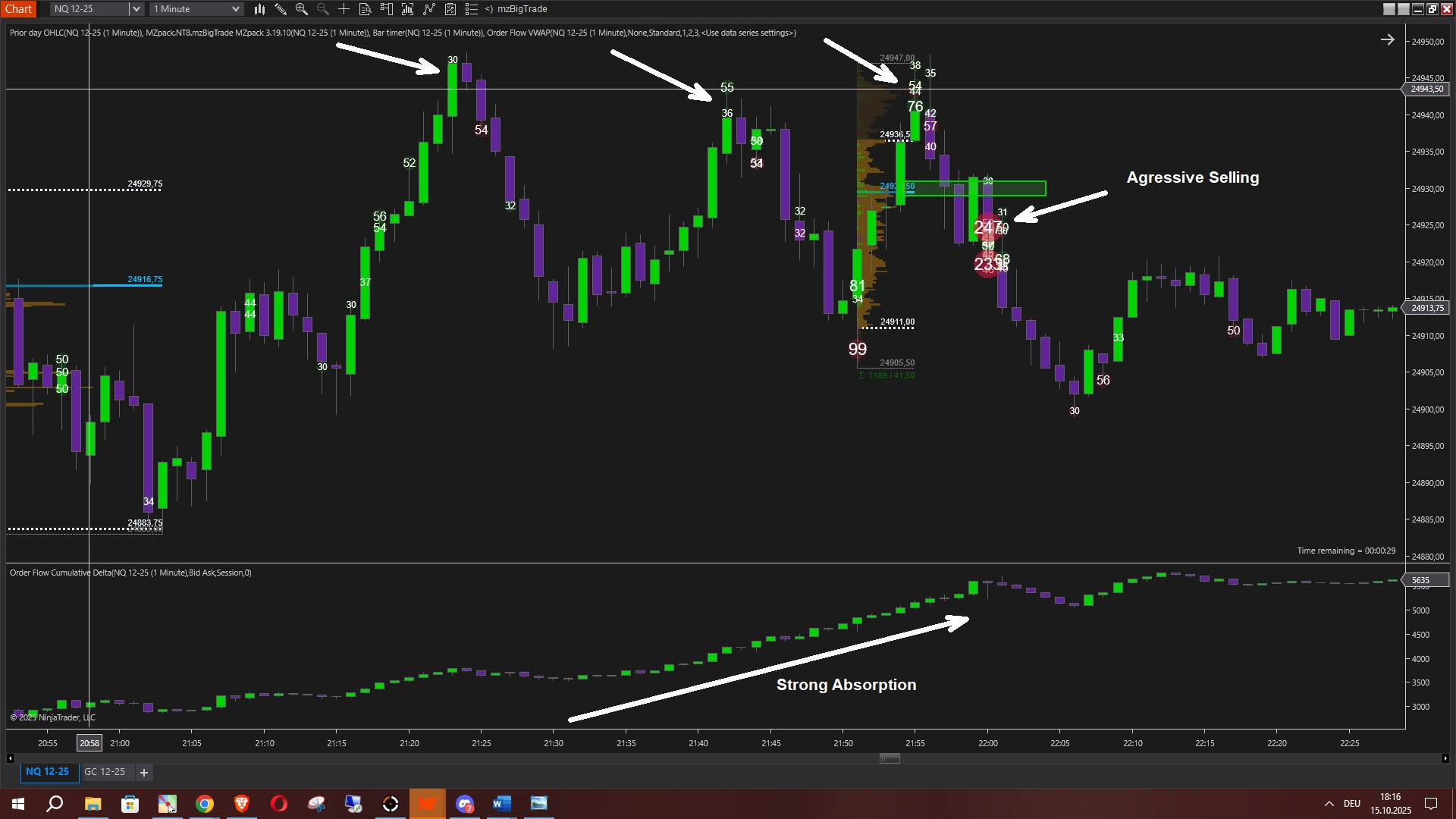

When price pulls back to the LVN, check for aggression:

- For Longs: Look for big BUY prints/imbalances

- For Shorts: Look for big SELL prints/imbalances

No aggression = No trade

STEP 4: Manage Your Risk

- Stop Loss: Just beyond the aggressive print + 1-2 tick buffer

- Position Size: Risk only 0.25% - 0.5% per trade

- Break-even: Move stop to break-even if CVD shows strong pressure

STEP 5: Take Profit

- Target: The POC (Point of Control) from the previous balance

- Exit: Close full position at POC

- Why? 70% of the time, price reverses from balance areas

🔄 Setup 2: MEAN REVERSION MODEL

Snap Back

Trade the snap-back when breakouts fail

Best Timing

- London session

- Compressed/summer market conditions

STEP 1: Confirm Market is in Balance

- Use previous day's profile as reference

- Watch for price trying to break out but failing

STEP 2: Wait for the Reclaim

Don't take the first move back - too risky

Wait for:

- Clear reclaim back inside balance

- A pullback after the reclaim

STEP 3: Find Your Entry

- Apply Volume Profile on the reclaim leg

- Mark the LVNs

- On pullback into LVN, check order flow for aggression:

- Big BUY prints after failed downside break

- Big SELL prints after failed upside break

STEP 4: Manage Your Risk

- Stop Loss: Just beyond aggressive print + 1-2 tick buffer

- Position Size: 0.25% - 0.5% per trade

- Rule: If wrong, you're wrong immediately - never widen stops

STEP 5: Take Profit

- Target: Balance POC (center of value)

- Exit: Full position at POC

- Don't stretch for other side unless conditions are exceptional

✅ Advantages

Clear Rules

No guessing, just follow 3 steps

Works in All Conditions

One setup for trends, one for ranges

Small Risk

Tight stops keep losses manageable

Many Opportunities

Lots of trades to build consistency

Prevents Overtrading

If conditions aren't right, don't trade

Good Risk/Reward

Typically 1:2.5 to 1:5, sometimes higher

⚠️ Things to Know

Multiple Small Losses Are Normal

You'll have losing streaks

Requires Full Attention

Need to watch during trading sessions

Lower Win Rate in Choppy Markets

Some days just don't work

Can Be Stressful

Managing positions requires mental strength

Important: These aren't disadvantages - they're just characteristics you need to accept and manage.

📝 Trade Checklist

Before entering ANY trade, confirm:

Market state clear (balanced or imbalanced)?

At key level (LVN from Volume Profile)?

Aggression confirmed (big prints in your direction)?

Stop loss placed?

Position size calculated (0.25-0.5%)?

If even ONE is missing → Don't trade

🎓 Key Terms Simplified

Balance

Price rotating in a range, buyers and sellers equal

Imbalance

One side dominating, pushing price directionally

POC (Point of Control)

The price level with most trading activity

LVN (Low Volume Node)

Price levels where volume was very low (fast moves)

Aggression

Large orders showing strong buying or selling pressure

CVD

Tracks if buyers or sellers are in control overall

💡 The Golden Rule

If the market isn't giving you clear conditions across all three filters (State + Location + Aggression), stay flat. Patience is profit.